Congratulations!

Your Free Download Should Already Be In Your Inbox!

Keep reading to discover how you can start repairing your credit within the next 24 hours:

Struggling to Increase your Credit Score? You're Not Alone!

"Break Free from Bad Credit:

Transform Your Credit With Our Tested and Proven Do-It-Yourself Dispute Letters"

Are you tired of feeling held back by your credit score?

Imagine this...

You're diligently working towards your financial goals, but every time you check your credit report, it feels like taking two steps back and one step forward.

You've been trying to puchase a home, but you constantly get denied over and over again because of the inaccuracies and the negative accounts on your credit report. You then settle for a rental home, but you continue to run into the same problems surrounding your credit. At this point, you're hoping that the Landlord will be gracious enough to overlook your bad credit and approve your application for the rental home.

Does this sound familiar?

The frustrations, burdens, and shame surrounding a bad credit report stops TODAY!

We have a THE SOLUTION that will ease your frustrations, lighten your burdens, and block the shame!

The Do-It-Yourself Approach to Better Credit

Many people have no clue they can challenge inaccuracies, demand validation of debts, and prevent their negative credit score from dictating their future. There are specific laws, loopholes, and legal approaches you can take to get your credit in order. Because most people don't know this information, they let their credit become a burden. No longer do they consider options like owning a home or getting a good interest rate on a new car.

Once you know how to properly dispute your credit report, you'll begin to notice a change with:

Negative accounts disappearing

Inaccuracies being corrected

A Higher Credit Score

With each improvement, you'll feel a renewed sense of hope and determination.

FINALLY you'll be able to buy that dream home or puchase that new car, change your life and take control of your financial future. You'll be able to write your own success story!

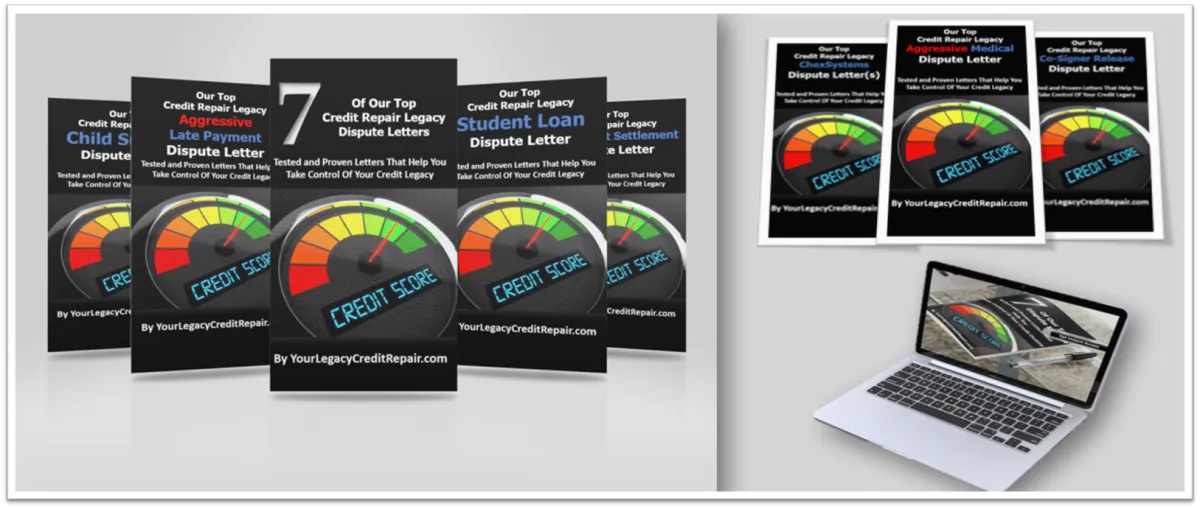

We've strategically put together a package that will get you started in the right direction of your DIY credit repair journey:

The Legacy Credit Repair DIY Dispute Letter Bundle

When reviewing a recent FTC study, we found that 1 in 5 consumers have errors and inacuracies on their credit report which cause them to get declined for loans that they simply should qualify for.

That's why we handcrafted specific letters for some of the most common situations out there that hold back people from pursing opporunities they deserve.

How To Leverage Our Expertise In Proper Credit Disputing As We Show You How To Fight For Your FCRA Rights (FCRA stands for Federal Credit Report Act)

The #1 Thing You Need To Do If You've Lost A Dispute Before And The Letter That Can Secure A Win

Discover What We Say In Each Letter To Challenge Unknown Errors That Have Been Plaguing Your Credit For Months Or Even Years

And Much More...

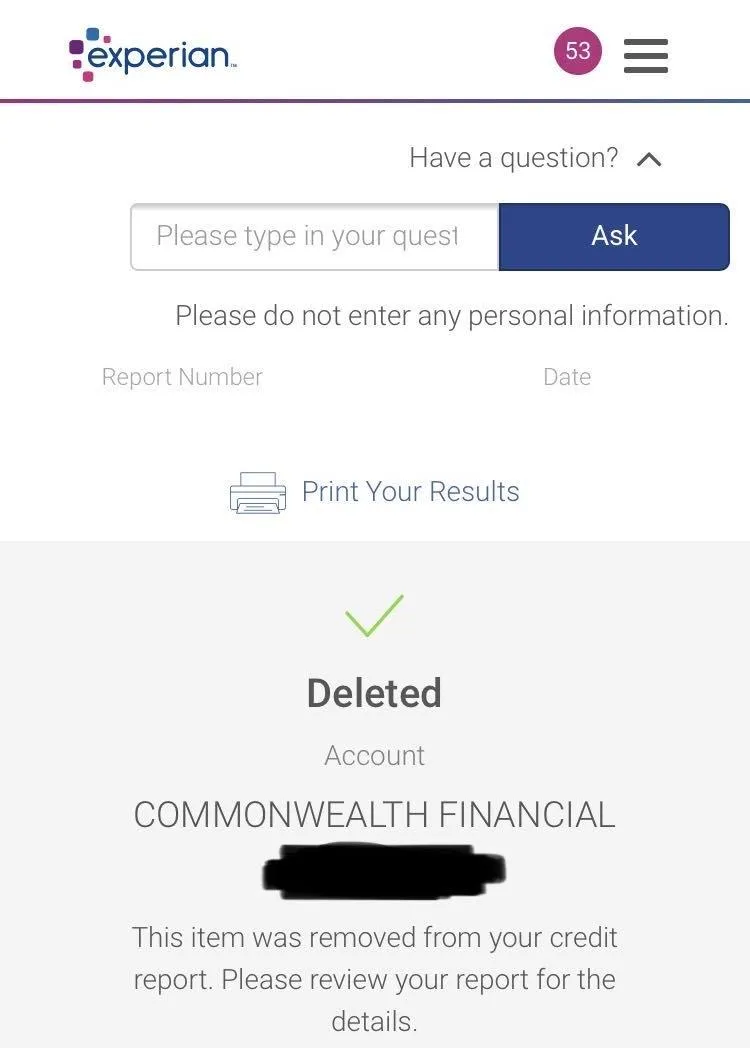

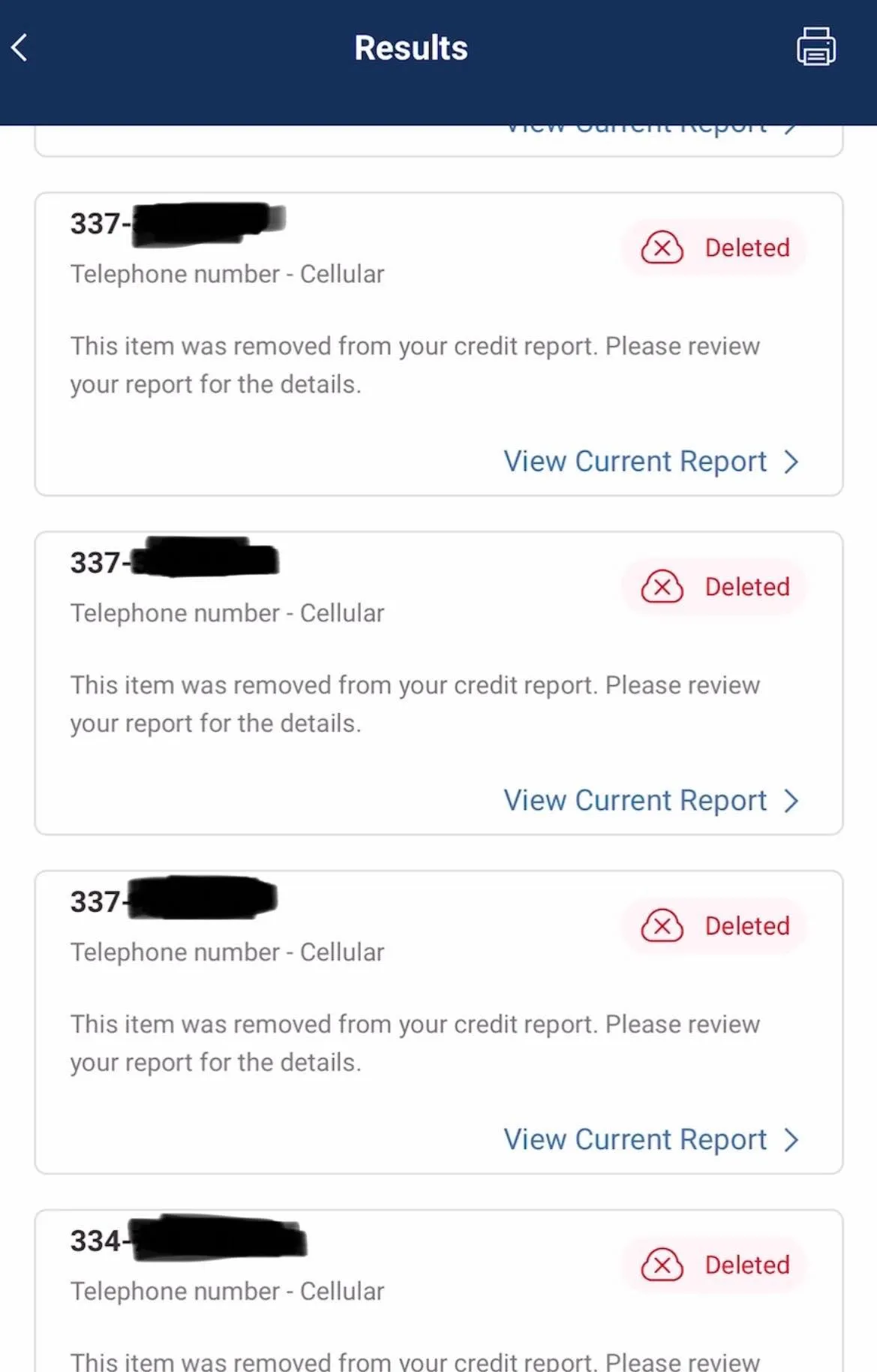

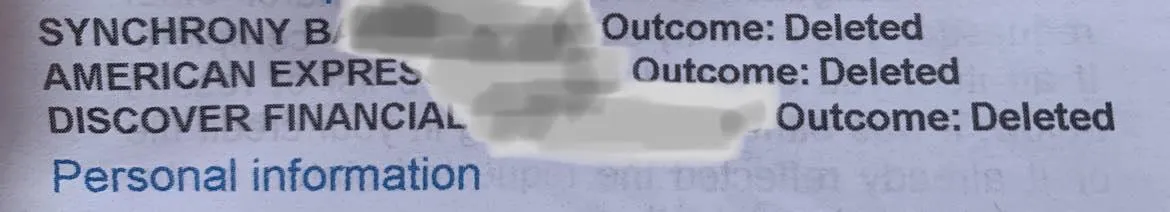

Do-It-Yourself Client Results

Here's What You'll Get Immediate Access To:

$27 Value

DIY Dispute Letter Instruction Guide

Our comprehensive instruction guide walks you through the process of effectively utilizing our dispute letters, providing step-by-step instructions and valuable tips to ensure you maximize your chances of success in disputing inaccuracies and improving your credit score.

$47 Value

Pre-Written Aggressive Late Payment

Dispute Letter

Combat aggressive reporting of late payments with our dispute letter, asserting your rights to dispute any unfairly reported late payments and ensuring that only legitimate instances are accurately reflected on your credit report.

$47 Value

Pre-Written

Judgement Settlement

Dispute Letter

Challenge inaccuracies related to judgment settlements with our dispute letter, demanding proper documentation to validate any reported settlements, ensuring your credit report is free from erroneous information.

$47 Value

Pre-Written

Student Loan

Dispute Letter

Our dispute letter for student loans helps challenge inaccuracies in loan balances, payment histories, or other details, ensuring your credit report accurately reflects your student loan status

$47 Value

Pre-Written

Medical

Dispute Letter

Combat aggressive reporting of medical debts with our dispute letter, challenging inaccuracies and ensuring that only valid and accurate medical debt information is reflected on your credit report.

$47 Value

Pre-Written Child Support

Dispute Letter

Use our dispute letter to contest any inaccuracies related to child support payments on your credit report, asserting your rights to ensure only accurate information regarding child support obligations is reflected.

$47 Value

Pre-Written

Co-Signer Release

Dispute Letter

Seek removal of co-signer obligations from your credit report with our dispute letter, enabling you to request the release of co-signers from relevant accounts, potentially improving your credit profile and relieving co-signers of financial responsibility.

$47 Value

Pre-Written ChexSystem

Dispute Letter(s)

Our dispute letter for ChexSystems enables you to challenge any erroneous entries, ensuring your ChexSystems report accurately reflects your banking history and mitigating any negative impact on your creditworthiness.

Here's Why We Could Realistically Charge $309

As previously mentioned, the dispute letters you're about to gain access to were pre-written with your FCRA rights in mind. When dealing with our normal clients, providing access to professionally crafted dispute letters along with expert guidance on how to use them effectively can range anywhere between $300 to $500.

Not only that but because we are confident in the success of our dispute letters, we know the value they hold and the strong potential it has to improve your credit. That alone is priceless!

However, one of the reasons we can offer this price is because we’re not shipping you anything. You get all the dispute letters and all the bonuses (found below) INSTANTLY!

Because of that, we’re releasing, “The Credit Repair Legacy Dispute Letter Bundle” at the lowest rate possible…

Normally $297

Today Just $47

We Fully Support All Our Products

With "The Credit Repair Legacy Dispute Letter Bundle"everything is digital, meaning you'll get Instant Access to everything after you order. You'll be able to download the letters in MS WORD DOC format right from our web site. No Physical Product will be shipped, which means no waiting!

Please note:

We will not be able to offer a refund on this bundle because everything is being given to you in digital format. We're also doing a limited time offer and offering it to you at over 90% off what we could realistically charge. With that being said, you'll have our full support.

If you have any issues, questions, or concerns with your order at any point, you can reach out to our team directly and get a detailed response on what you need to do. Our email is [email protected] and we usually respond within 24 to 48 hours.

Here's What You Need To Do Now

To get your hands on "The Credit Repair Legacy Dispute Letter Bundle”, complete your purchase

by using our secure order form below.

CEO Bonus Special: Our CEO Dorthea Ferren is Adding

Two Amazing Bonuses

Bonus # 1: Step By Step DIY Dispute Letter Video Tutorial

This video tutorial offers a detailed explanation of how to properly fill in the required information. From addressing inaccuracies to disputing negative accounts, even if you're not that tech-savvy, you'll be able to confidently utilize our dispute letters to improve your credit health.

Bonus # 2: Statue of Limitations Guide

This guide outlines the time limits for pursuing legal action on debts, ensuring that you have a clear understanding of your rights under the law. This resource provides invaluable information to help you make informed decisions and protect your financial interests.

Once you fill out the form below and checkout, we’ll move you onto the next step towards taking control of your credit repair legacy, and will also email you the details you’ll need for instant access!